Conclusion:

- By several measures, ocean freight rates have come down this year after soaring on unprecedented consumer demand during the pandemic. But transportation costs for some trade lanes are still more than five times higher than their five-year average before the pandemic

- Falling demand has driven container spot freight rates lower on a weekly basis over the last four months and high inflation is eroding confidence that volumes will stage much of a comeback.

- Shanghai has been ramping up production since the lockdown, but consumer demand in Europe has been held back by rising inflation.

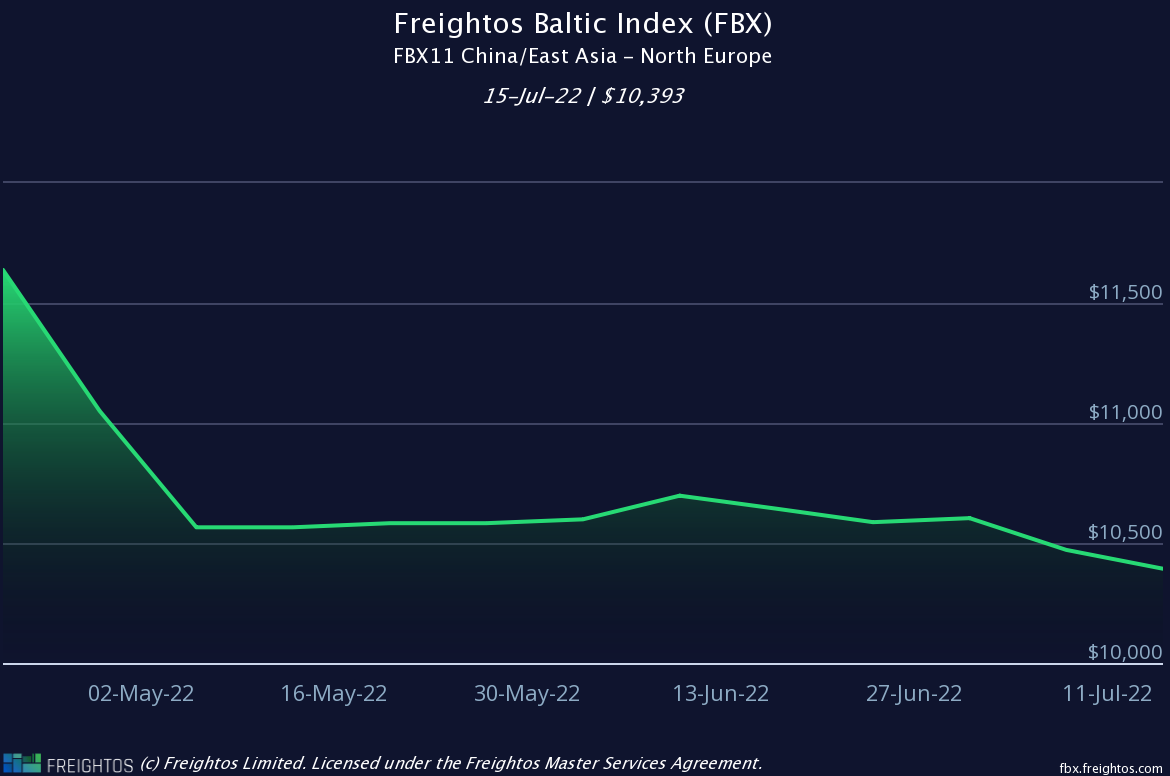

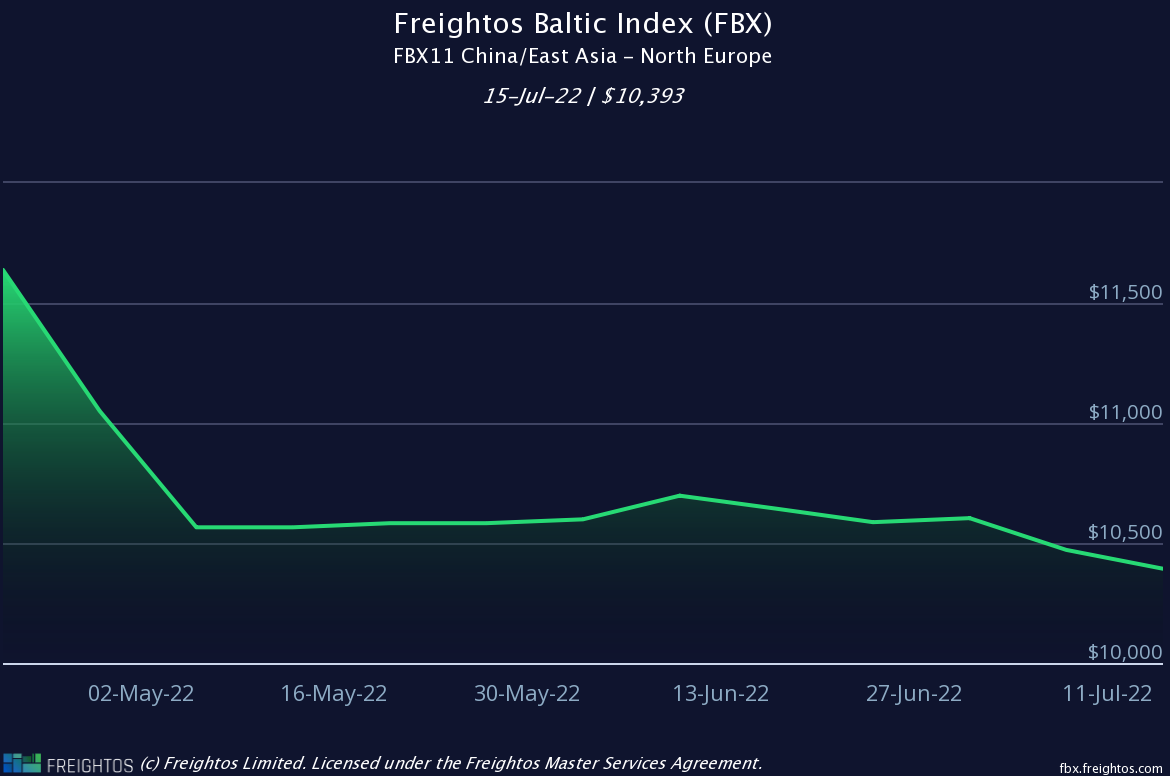

- Nonetheless, strikes at German ports and congestion at other North European container hubs is preventing more substantial slump in spot rates. Rates for North Europe and the Mediterranean are holding steady at about $10,000 and $12,000 per 40 ft respectively, according to the latest readings from the WCI, FBX and XSI spot rate indices. Port congestion in North Europe is taking out significant capacity as ships suffer longer wait times to berth and slower working alongside, and this could tip the supply and demand balance back in favour of the shipping lines in the coming weeks.

- So, the port congestion in Europe is still a major issue which delays schedules and more blank sailings have been announced by all carriers and alliances. The equipment situation remains tight, especially for 40HC equipment.

- The price of newbuild container ships keep rising, yet liner operators and ship-owning companies keep placing more orders at Asian yards, guaranteeing an ever-larger deluge of new vessels in 2023-25

- Drewry’s Container Forecaster l expects the container shipping market to grow 2.3% in 2022.

- Significant loosening of the container market from 2H2023 is expected, when the supply chain congestion is expected to have cleared. It will also coincide with a significant influx of newbuild containerships.

- Until the end of the year, it is likely that the current rates for sea transportation will remain the same, or they will slightly decrease. A more significant reduction in rates and the transportation market should be expected in 2023.

Main indicators

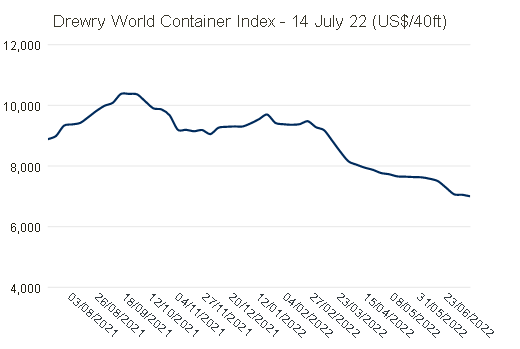

The Drewry World Container index has been falling since March 2022 on the all trade routes with Shanghai. World container rates decrease due to reduced congestion in Chinese ports with the easing of COVID-19 restrictions in Shanghai.

So, the composite index decreased by 0.7% on 27 week, and has dropped by 21% when compared with the same week last year.

The average composite index of the WCI, assessed by Drewry for year-to-date, is $8,321 per 40ft container, which is $4,788 higher than the five-year average of $3,533 per 40ft container.

Drewry, in USD/40ft container, including BAF & THC both ends, 42 individual routes, excluding intra-Asia routes

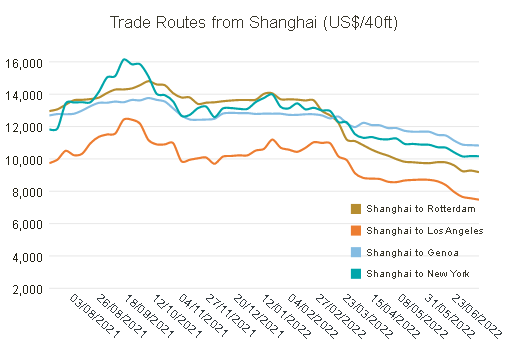

Compared to last year, rates increased in the directions New York-Rotterdam, Rotterdam-New-York.

However, recent weeks show that strikes at German ports and congestion at other North European container hubs is preventing a slump in spot rates.

Rates for North Europe and the Mediterranean are holding steady at about $10,000 and $12,000 per 40 ft respectively, according to the latest readings from the WCI, FBX and XSI spot rate indices [2].

Port congestion in North Europe is taking out significant capacity as ships suffer longer wait times to berth and slower working alongside, and this could tip the supply and demand balance back in favour of the shipping lines in the coming weeks [3].

|

|

Increased berthing delays and slow-ship working on severely congested quays, will result in carriers announcing a high number of blanked sailings from Asia in August and September with shippers suffering serious delays to their supply chains.

All things considered, Drewry’s Container Forecaster still expects the container shipping market to grow 2.3% in 2022, although it admits that the projection is “certainly not a given, especially with the speed at which economists are downgrading GDP projections.”

Market outlook

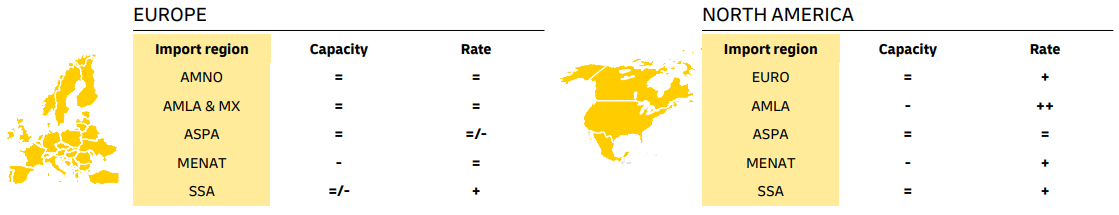

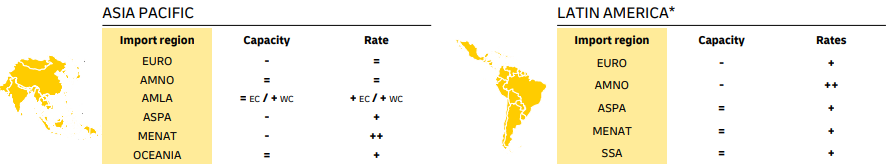

Market outlook July 2022 month-on-month development

AMNO - North America, ASPA- Asia-Pacific, EURO – Europe, AMLA & MX – Latin America and Mexica, MENAT - Middle East and North Africa,SSA - Sub-Saharan Africa

Major trades

|

· Asia-Pacific - Europe |

The port congestion in Europe is still a major issue which delays schedules and more blank sailings have been announced by all carriers and alliances. The equipment situation remains tight, especially for 40HC equipment |

|

· Asia-Pacific-North America |

With Shanghai gradually returning to normalcy, factory production is picking up and volume are improving from July. |

|

· Europe-North America (USA) |

Tariff negotiations on the West Coast between the ILWU (Longshoremen union) and PMA (Pacific Maritime Association) are ongoing. Neither party is preparing for a strike or a lockout.. The parties are committed to reach an agreement. Truck and especially chassis availability remain a concerning topic. Port omissions will continue as carriers are aiming to compensate vessel delays caused by the ongoing congestions |

|

· Europe-Asia-Pacific |

No big issues with capacities. Rate-wise, it is mostly seen reductions to Asia. |

|

· North-America-Europa |

Capacity remains stable for Q3. |

|

· North-America-Asia-Pacific |

Rates and Capacity are stabilizing after the blitz of Imports and carriers prioritizing empties back to Asia. |

Shortage of ships

Ocean carriers are being forced to make difficult choices as there are not enough container ships to fully staff all regular liner services.

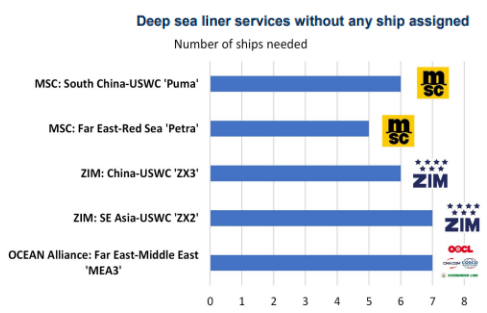

- Fourteen deep sea liner services are currently missing half (or more) of the number of ships required to guarantee a fixed weekly sailing frequency.

- Five loops are even missing all of their ships and could be considered as ‘temporarily suspended’.

- In order to mitigate consequences for shippers, carriers provide alternatives by adding ad hoc calls on other loops or deploying numerous ships with very flexible routings. Currently 52 ships (representing a capacity of 270,100 TEU) are deployed as extra sailors on the Asia – North America trade.

- The capacity reduction feeder services has allowed carriers to shift tonnage to other trades. However the redeployment has a minimal impact on the worldwide shortage of container ships, as the 80,700 TEU of fleet capacity which has been transferred routes only represents 0.3% of the global container fleet.

Container-ship building: new orders still rising

The price of newbuild container ships keep rising, yet liner operators and ship-owning companies keep placing more orders at Asian yards, guaranteeing an ever-larger deluge of new vessels in 2023-25.

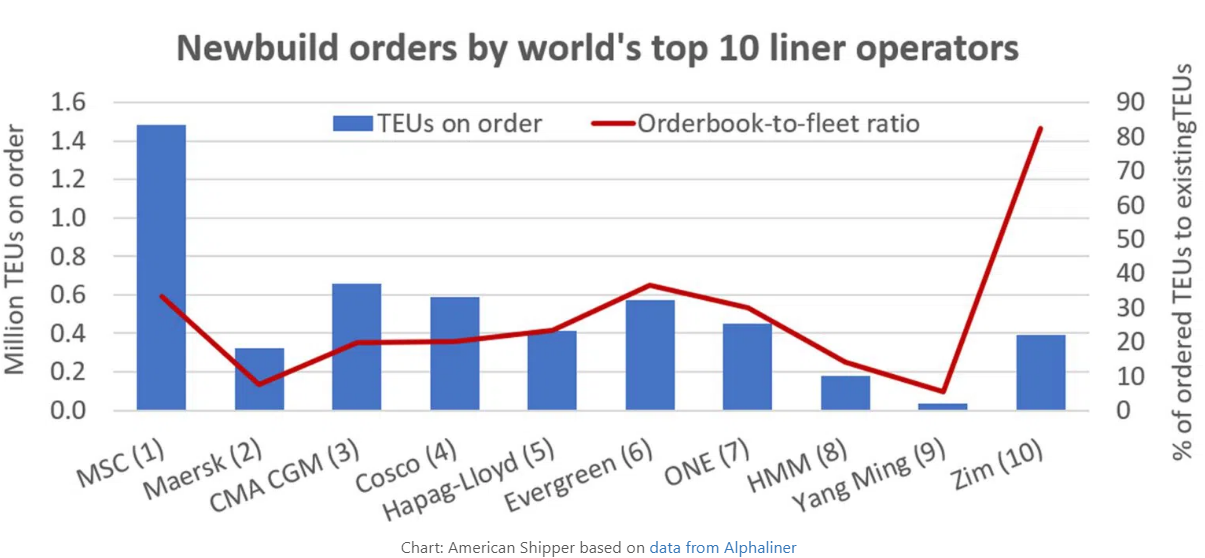

Capacity on order has now reached 27.9% of on-the-water capacity, according to Alphaliner. The ratio was a mere 8.2% at the cycle low in October 2020 [11].

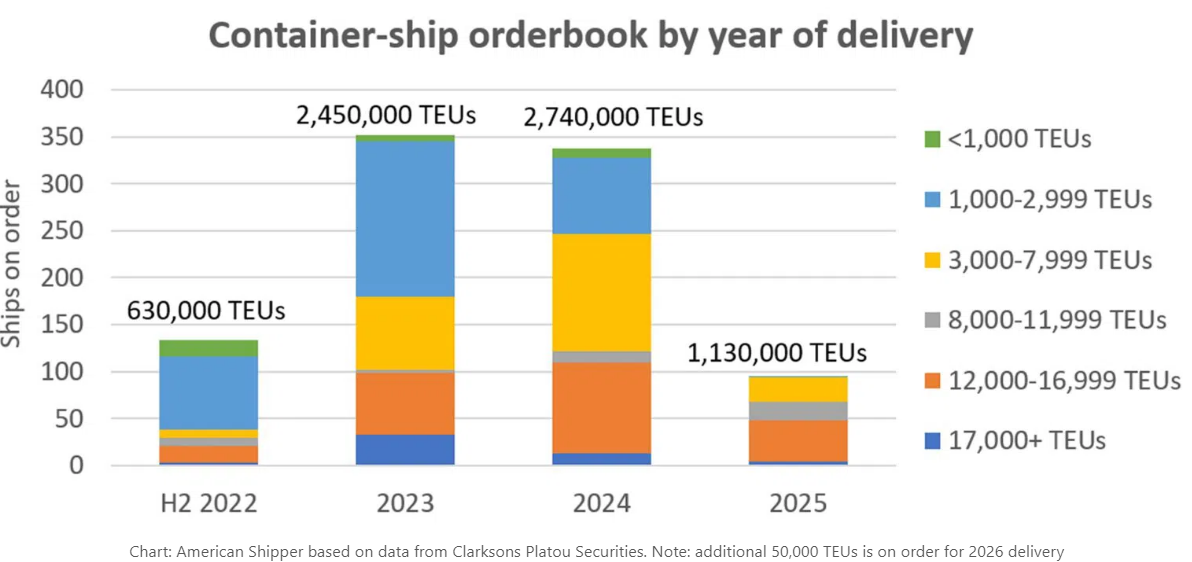

Total capacity on order now tops 7 million twenty-foot equivalent units. The next two years will see major capacity infusions, according to Clarksons Platou Securities: 2.45 million TEUs in 2023 and 2.74 million TEUs — 9.8% and 10.9%, respectively, of on-the-water tonnage.

MSC has by far the largest order book, at 1,482,178 TEUs, according to Alphaliner (including chartered ships ordered by intermediaries). MSC’s order book capacity is now 33.4% of its on-the-water fleet. Evergreen has an order book-to-fleet ratio of 36.7%, with ONE at 30% and Zim (NYSE: ZIM) at 82.3%.

The order book has grown bigger than the combined capacity of the existing fleets of the world’s fourth, fifth and sixth largest carriers: Cosco Shipping, Hapag-Lloyd and Evergreen [5].

Most of the new vessels don’t come on-stream until the second half of 2023. That’s when we would start to see a material impact on the supply-demand balance.

Sources:

- https://www.drewry.co.uk/supply-chain-advisors/supply-chain-expertise/world-container-index-assessed-by-drewry

- https://fbx.freightos.com/

- https://theloadstar.com/spot-rates-underpinned-by-congestion-while-demand-falls/

- https://theloadstar.com/german-dockers-begin-two-day-strike-adding-to-congestion-woes/

- https://www.freightwaves.com/news/container-ship-building-spree-is-not-over-yet-new-orders-still-rising

- https://en.sse.net.cn/indices/scfinew.jsp

- https://ajot.com/news/article/container-shippings-equipment-surplus-is-manageable-and-will-recede

- https://www.dhl.com/content/dam/dhl/global/dhl-global-forwarding/documents/pdf/glo-dgf-ocean-market-update.pdf

- https://gcaptain.com/drewry-beginning-of-the-end-for-container-shippings-bull-run/

- https://www.maersk.com/news/articles/2022/06/24/asia-pacific-market-update-june

- https://www.hellenicshippingnews.com/container-ship-building-spree-not-over-yet-new-orders-still-rising/